So, where are prepaid expenses recorded? Prepaid expenses in balance sheet are listed as assets, too. When you initially record a prepaid expense, record it as an asset. Maybe you’re thinking … It’s an expense, right? I mean, expense is in the title! Although that’s a fair assumption, it’s not correct.Ī prepaid expense is an asset. As a reminder, the main types of accounts are assets, expenses, liabilities, equity, and revenue. You might be wondering what type of account is a prepaid expense.

#Prepaid expenses appear in the how to

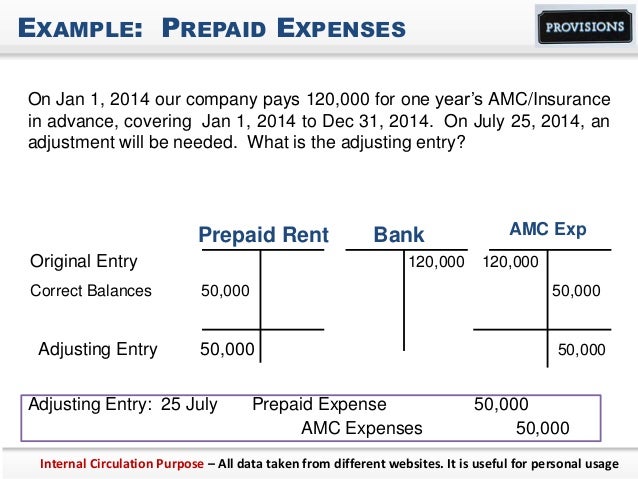

So, do you know how to record prepaid expenses? Don’t panic if you don’t. You need to create a prepaid expenses journal entry. However, it seems necessary to implement this operation diligently, progressively, and with the help of all the people in the business who are involved in these expenses.Do you ever pay for business goods and services before you use them? If so, these types of purchases require special attention in your books. Gathering and then recording your prepaid expenses can have an upward effect on your earnings.

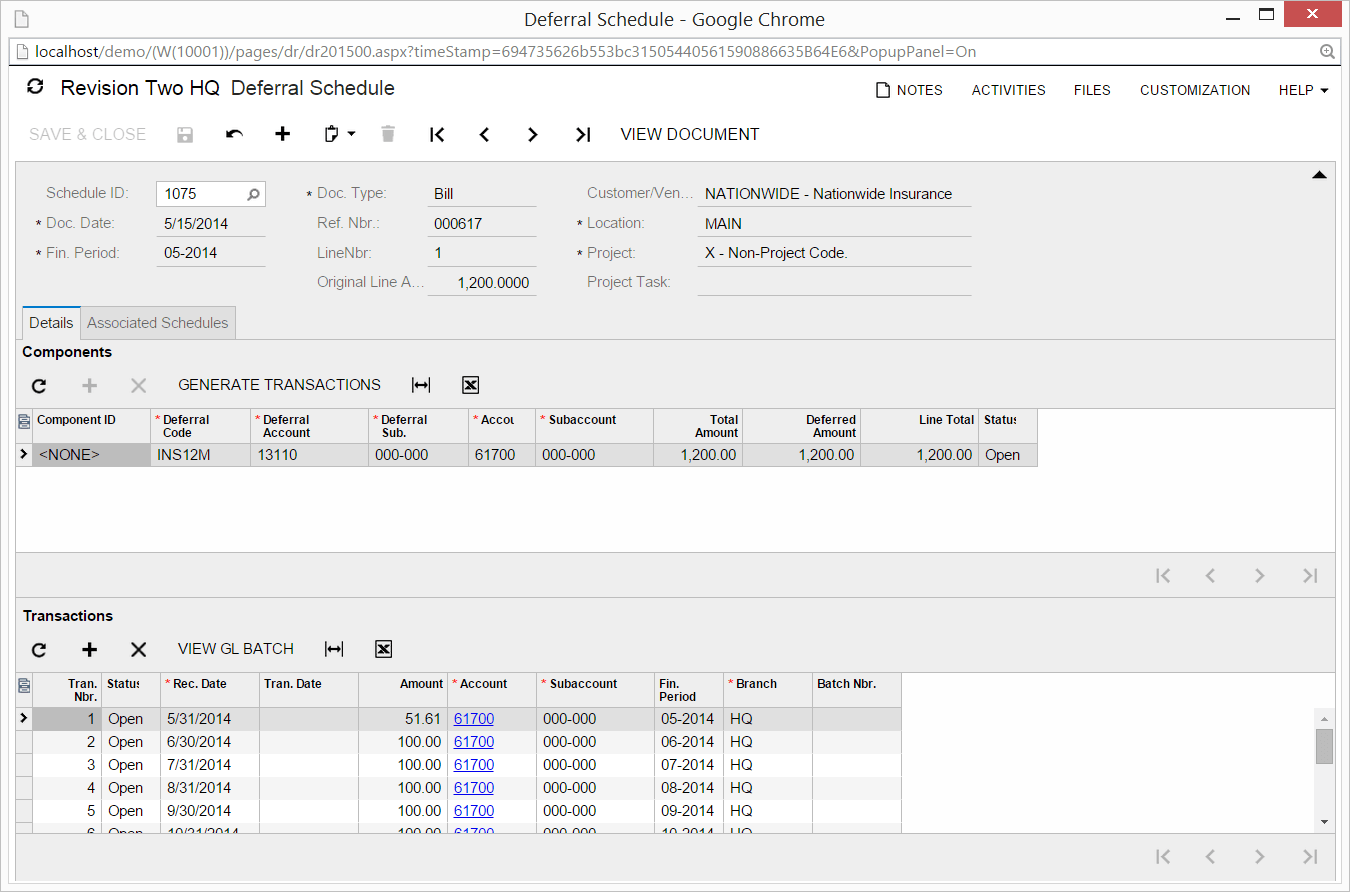

The information will be mapped out and listed in a single space that is accessible at any time.

Communication, now more free-flowing, will allow the different teams to exchange reliable data in real-time. They will be able in turn to juggle from one fiscal period to another, achieving the appropriate financial consolidations to minimize the overall expenses of the business. The list thus kept up-to-date via the shared table, will facilitate the gathering of information by the accounting and financial teams. For example, they may specify the name of the supplier, the invoice and associated account numbers, the contract’s duration, the amount of the prepaid expense, and finally, the receipt that must be attached to the table (a document automatically filed, archived, and accessible to authorized users).

As a result, they directly impact a business’s accounting and therefore the management of your budget. They are for purchased services or goods that are not fully consumed during the current fiscal period. How do you gather your receipts for prepaid expenses in real-time in the most efficient way? Take notice now of easy-to-use tools in this article… Listing these prepaid expenses as well as their receipts constitutes a preliminary step to a proper accounting exercise. Taking these expenses, known in advance (as the name suggests), into consideration is thus possible and even recommended. There is nothing more normal and reassuring! In fact, they represent the structure costs that ensure the smooth operation of your business. Business owners, entrepreneurs, your company faces expenses of all kinds, which rise to more or less substantial quantities.

0 kommentar(er)

0 kommentar(er)